ALERT: Take Charge of Your Credit: A Do-It-Yourself Guide to Raising Your Credit Scores

★ UNLOCK YOUR FINANCIAL POWER ★

See The Internets #1

DIY System To Boost Your Credit Scores!

Use Our Do-It-Yourself System To Potentially Remove Late Payments, Collections, Charge Offs & So Much More...

Get Access For Just $0.95

Then $39.95/mo to maintain access.

Take control of your credit score and secure your financial future.

★ UNLOCK YOUR FINANCIAL POWER ★

See The Internets #1

DIY System To Boost Your Credit Scores FAST!

Use Our Do-It-Yourself System To Potentially Remove Late Payments, Collections, Charge Offs & So Much More...

Get Access For Just $0.95

Then $39.95/mo to maintain access.

Take control of your credit score and secure your financial future.

*You can potentially delete Charge Offs, Collections, Repos, Bankruptcies, Medical Bills, Foreclosures, Late Payments, Evictions, Utility Bills, Student Loans, Judgements and so much more using the myEcon Do-It-Yourself System...

*You can potentially delete Charge Offs, Collections, Repos, Bankruptcies, Medical Bills, Foreclosures, Late Payments, Evictions, Utility Bills, Student Loans, Judgements and so much more using our Do-It-Yourself Credit Boost System...

Meet Steven & Lanacia Rachel

The My Econ DIY System is our proven step by step guide thousands of people have used to assist themselves in increasing their credit scores.

Imagine getting access to the guarded secrets the credit bureaus are hiding from all us us. You'll learn everything you'll need to impact your credit score in a positive way. It's time to stop imagining and start learning.

Inside you'll learn how to find out if there are mistakes on your report, what your scores are and more importantly how to fix it following our detailed Do It Yourself system.

I personally love the fact that everything is all in one place. When you get inside the MyEcon DIY system, you'll see all the resources, documents, letters, videos and more systematically organized for an EASY step by step learning experience.

If you are ready to learn how to dramatically enhance your credit scores without paying a ton of money to credit repair gurus or agencies, get started today! Let's make this your financial BREAKTHROUGH YEAR!

Get Full Access To The Internets #1 Do-It-Yourself Credit Repair System!

Take control of your credit score and secure your financial future.

Steven & Lanacia Rachel

Your Credit Partner

Get The MyEcon System Now!

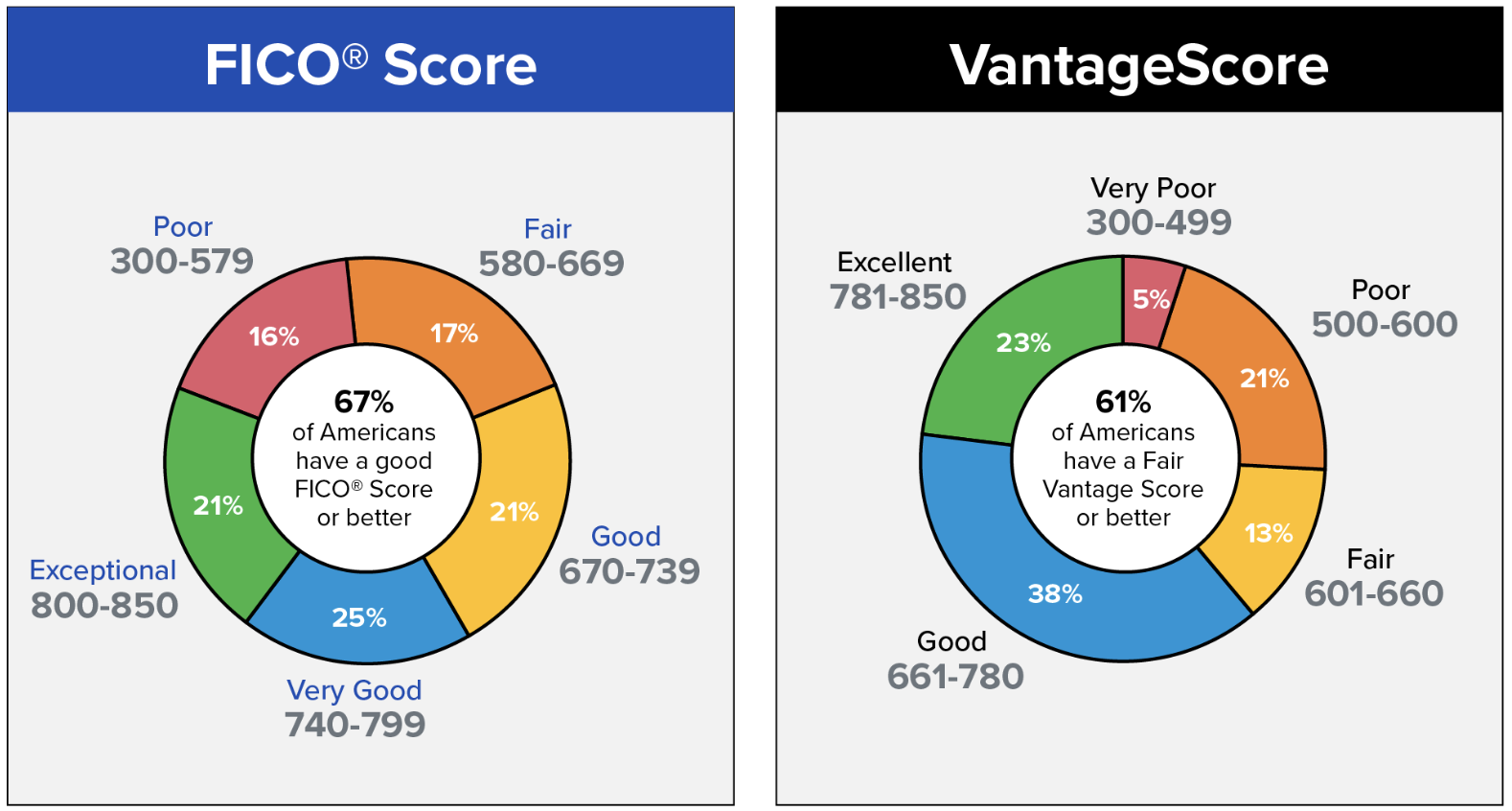

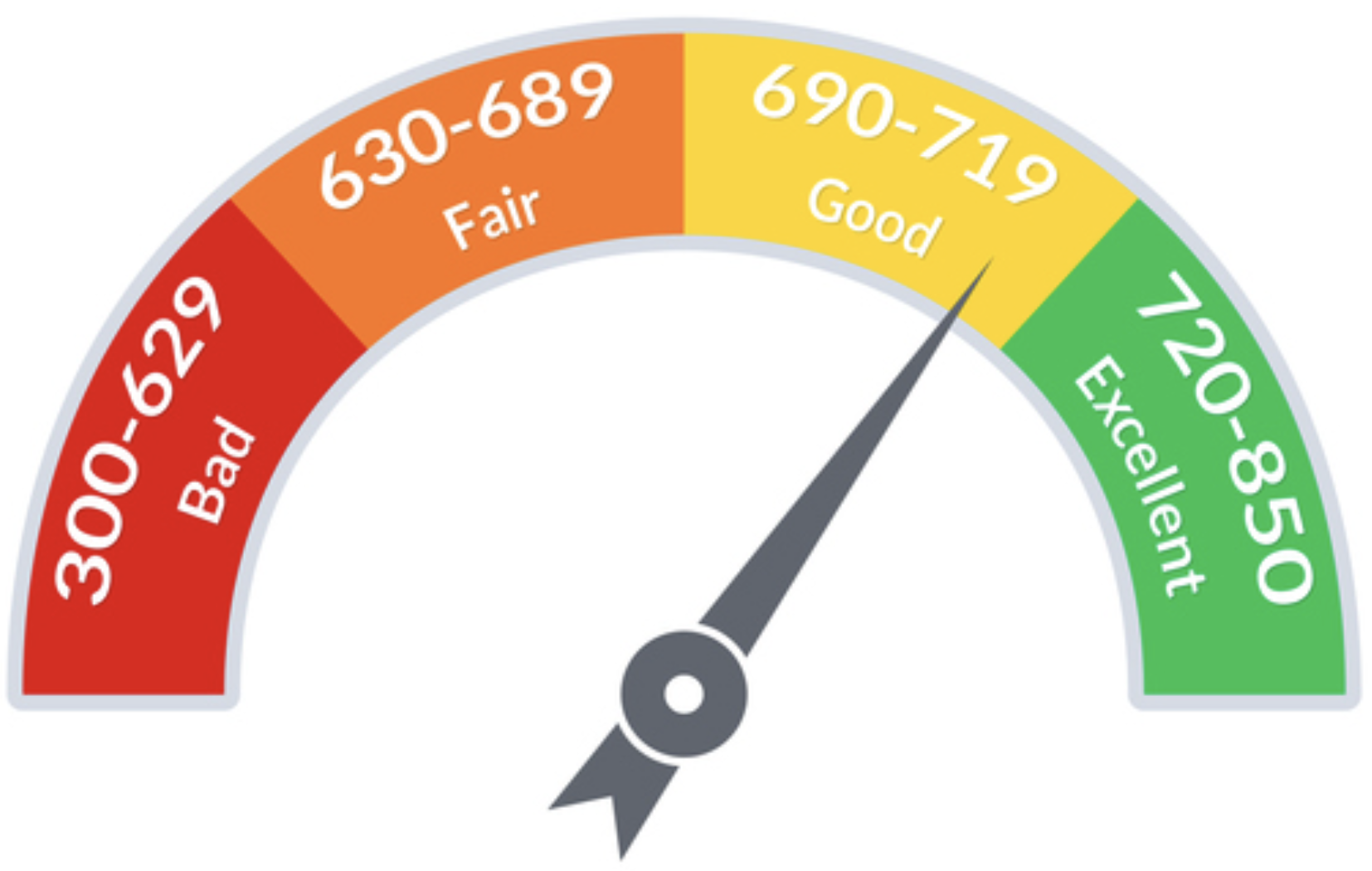

What Is A Good Credit Score?

For FICO, a good credit score is 670 or higher; a score above 800 is considered exceptional.

For Vantage Score 3.0, a good score is 661 or higher, and a score of 781 to 850 is excellent.

On the flip side, FICO scores below 670 fall into the fair and poor range, while Vantage Score 3.0 scores below 660 are considered fair, poor, or very poor.

FICO and Vantage Score aren't the only credit scoring models. However, they are the most commonly used models and the ones used by the three major credit bureaus: Experian, Equifax, and TransUnion.

Some lenders even have their own scoring models. But most lenders and credit card companies use FICO scores or Vantage Scores.

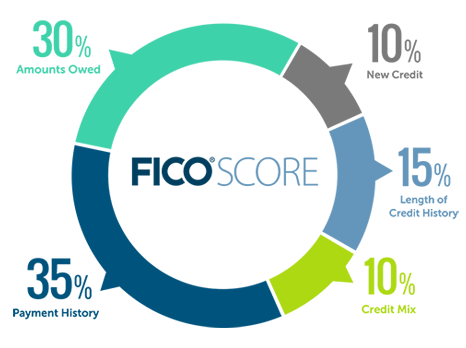

How Are Your Scores Generated?

There are 5 Factors that make up your credit scores.

1. Payment History - 35%

One of the most significant elements that make up a credit score is payment history. Your payment history documents whether you've paid your bills on time and outlines a detailed history of your bill payments for each of your reported accounts.

2. Credit Utilization - 30%

When it comes to your credit scores, the amount of debt you owe also commonly referred to as your credit utilization is second in importance.

Credit utilization is how much debt you're carrying versus how much credit has been extended to you collectively and on individual credit cards.

3. Credit History - 15%

Length or age of credit history is how long you've had credit lines in your name. It accounts for about 15% of your credit score, and there's not much you can do except be patient to help this factor improve.

4. Credit Mix - 10%

What does credit mix mean? Basically, credit scoring models want to see that you can manage different types of financing, most notably revolving accounts, such as a credit card, and installment accounts, such as a mortgage or auto loan.

5. New Credit - 10%

Also known as credit inquiries, the pursuit of new credit negatively affects your score. Every time you apply for credit, your score goes down. There are some exceptions to this rule.

How To Get Your Credit Reports For FREE

You can get a free credit report once every 12 months from each of the three nationwide consumer credit reporting companies through AnnualCreditReport.com

How To Get Your Credit Scores For FREE

Here are 3 resources that you can use to get your credit scores for FREE.

For Experian |

https://www.credit.com/

For TransUnion |

https://wallethub.com/

For Equifax |

https://www.creditkarma.com/

Invest in your credit score and watch it pay off in a BIG way!

MyEcon is the best option for those who want to take control of their financial future and improve their credit score.

With our comprehensive guide and easy-to-use tools, you'll learn all the secrets the credit bureaus don't want you know. Don't let a low credit score hold you back any longer... Take the first step towards financial freedom.

Training Videos

Powered by MyEcon's myCredit System

The myCredit System is a series of short do-it-yourself credit repair training videos designed to teach you how to repair; rebuild; and maintain a great credit score.

Automated Dispute Letter Writer

Powered by MyEcon's myCredit System

With this tool you'll be able to create a library of dispute letters with a few clicks that can be customized and generated automatically. This will save you a lot of time and make you more efficient.

These letters have been used by other members to get results time and time again. That means they could potentially work for you as well!

Re-Establish Credit Resources

Powered by MyEcon's myCredit System

As older negative items are being removed from your credit reports it's important to add new lines of credit on your credit profile. Inside the system you'll find numerous resources that can add positive history on your reports!

CashFlow Manager App

Powered by MyEcon's myCredit System

The CashFlow Manager App allows you to track your income and expenses so you can stay on task with building your credit scores.

Debt Eliminating Software

Powered by MyEcon's myCredit System

Our debt elimination calculator can empower you to eliminate your debt quickly and shift cashflow back to you.

Take control of your credit score and secure your financial future.

IT'S EASY TO GET ACCESS

Follow These 3 Steps To Get Access To The MyEcon System...

Get Started!

With our detailed step by step instructions, we'll show you exactly what to do and hold your hand through the entire process to Boost your scores.

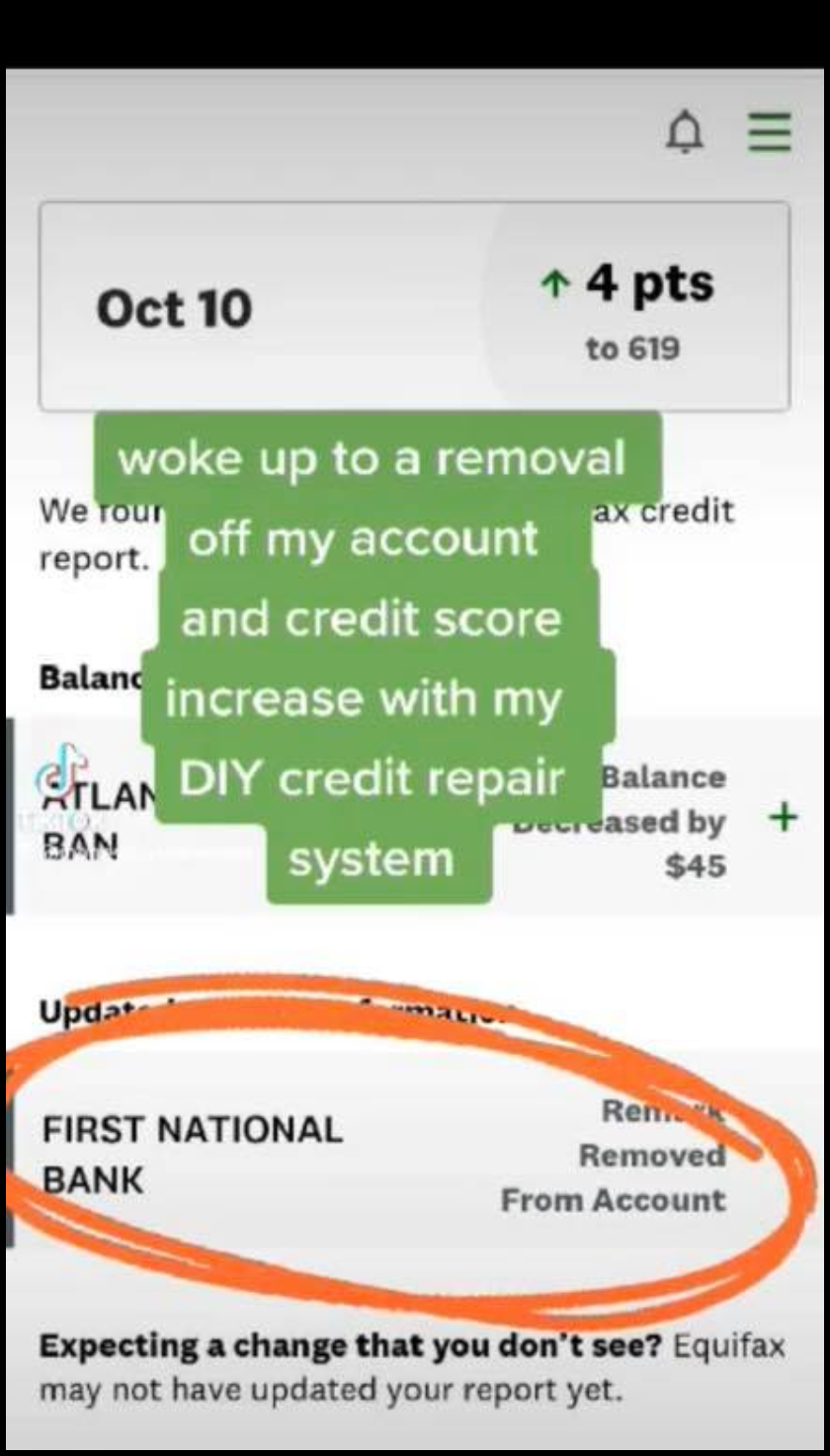

Watch Your Credit Scores Go Up!

During this process can potentially start seeing positive changes on your credit reports which can enhance your Credit Scores.

Get Access For Just $0.95

Take control of your credit score and secure your financial future.

This Is For You If:

You're tired of getting denied credit when you need it the most.

You want to remove errors from your credit report.

You don't want to spend a ton money using a credit repair company.

You want to be able to drive the car you want and not settle for a vehicle you really don't want.

You're ready to buy your dream home and get the best interest rate.

You want to learn the secret credit strategies that can benefit you for years to come.

This Is The Opportunity You've Been Waiting For. Take Advantage Now!!!

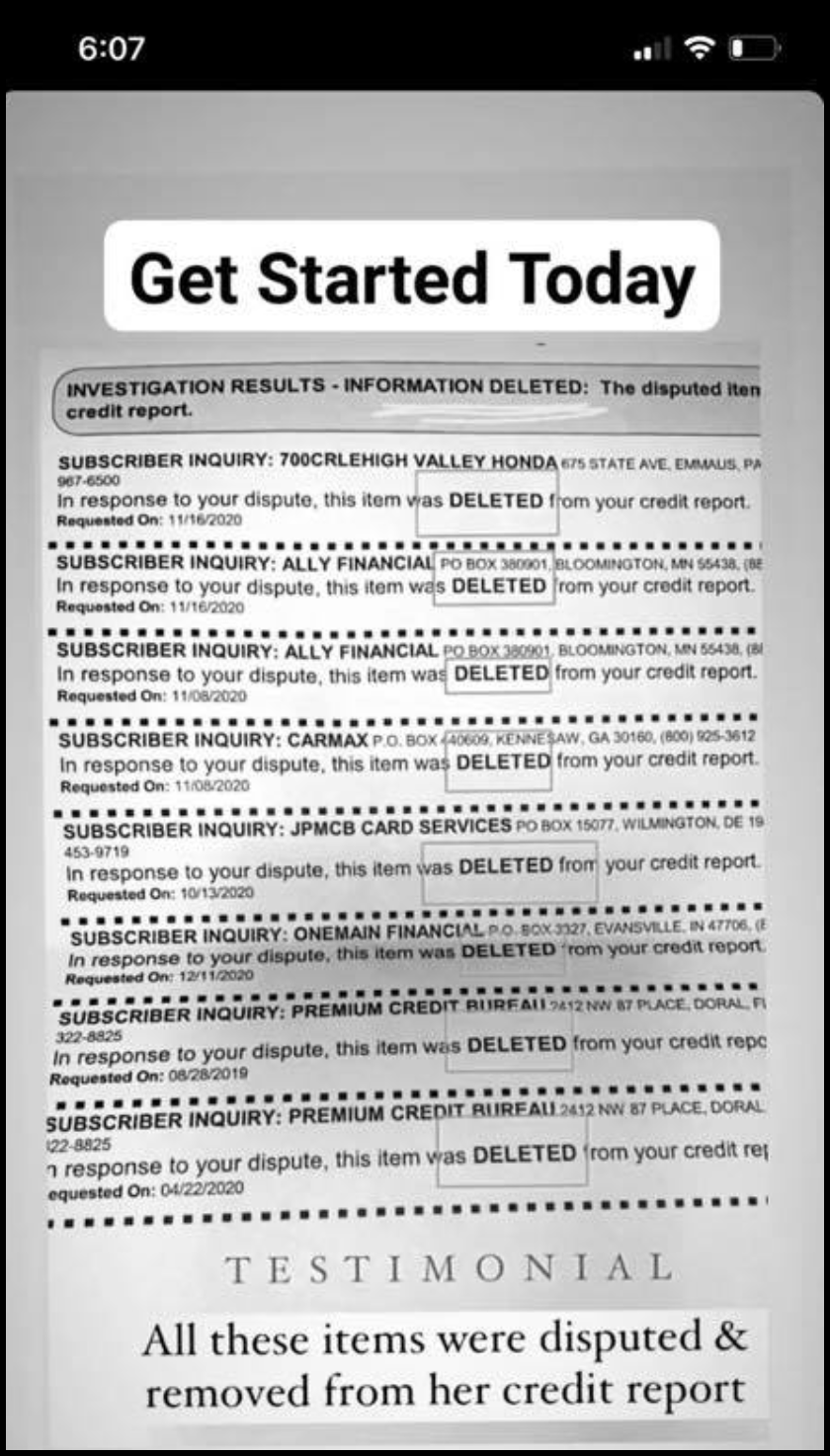

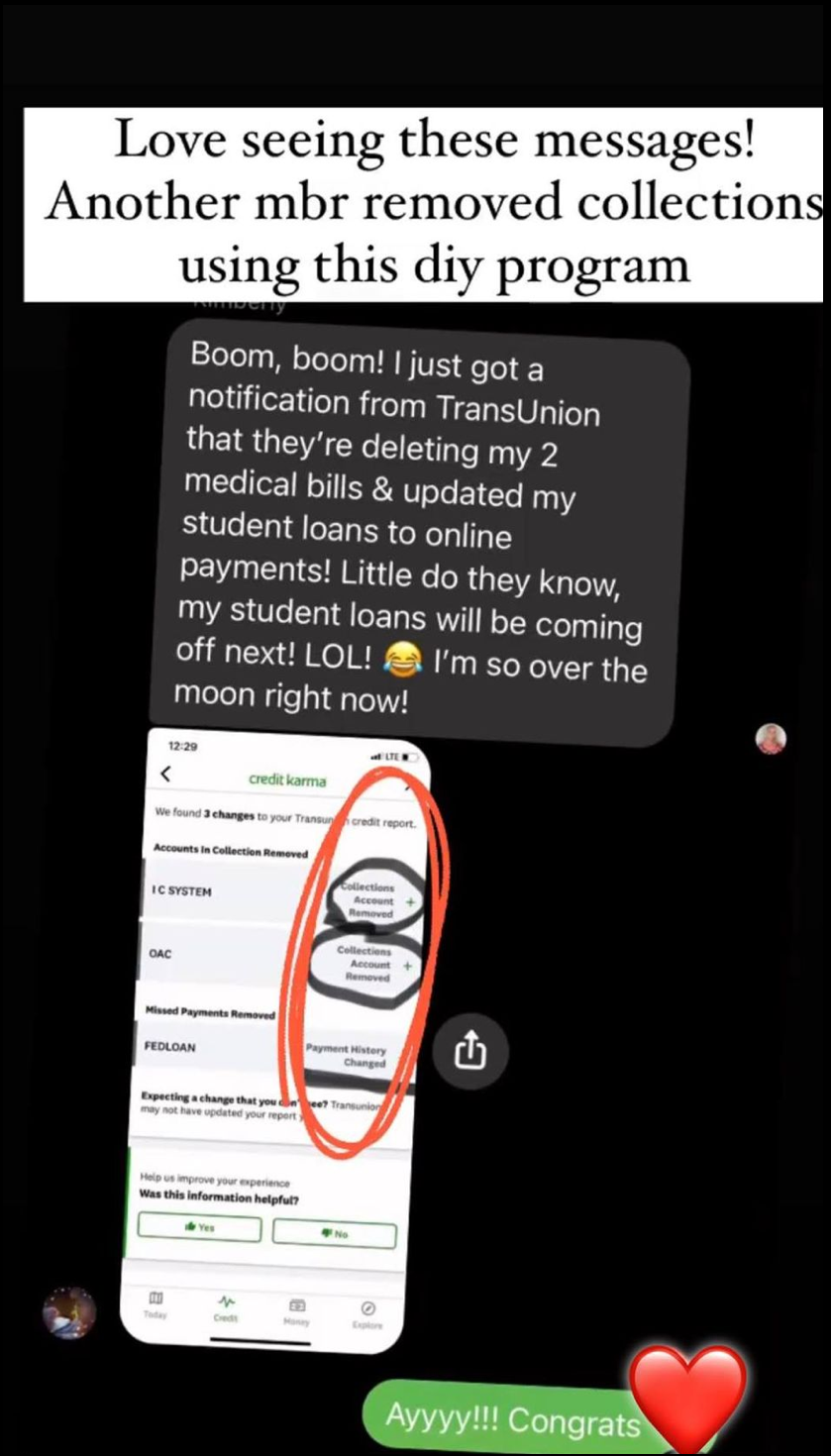

You're Next... We Can't Wait To Hear Your Story...

The MyEcon Do-It-Yourself System Has Already Helped Thousands Of People And Now...

It's Time To BOOST Your Scores!

Take control of your credit score and secure your financial future.

HERE'S WHY HAVING GOOD CREDIT IS SO IMPORTANT RIGHT NOW...

The Truth Is... If You Don't Have Good Credit, Life Can Be Really Difficult...

Allow me to explain...

Having good credit is important because it can affect many aspects of your financial life.

A good credit score can make it easier to get approved for loans, credit cards, and other types of credit, and you may be able to qualify for lower interest rates and more favorable terms.

#2: Getting Apartment Rentals & Jobs.

Good credit can also help you rent an apartment, get a cell phone plan, and even get a job in some cases.

#3: Better Insurance Rates.

Our goal with MyEcon is to give you everything you'll need to restore your credit yourself.

That's why we've included 4 additional bonuses at no additional cost to you.

Each of these bonuses serves a very specific purpose - to help you to Boost your Scores!

Without further ado, here are the bonuses you'll get for free when you get started today with MyEcon!

Get started with MyEcon & get each of these bonuses mentioned above 100% free...

Take control of your credit score and secure your financial future.

YOU MIGHT BE THINKING...

But Isn't It Difficult To Boost Your Credit Scores...?

Here's What You'll Get When You Get Started With MyEcon Today...

DIY Credit Boost System Video Training ($297 Value)

CashFlow Manager App ($97 Value)

Debt Eliminating Software ($67 Value)

Automated Dispute Letter Writer ($197 Value)

Re-Establish Credit Resources ($97 Value)

Total Value: $775.00

But if you get access to the MyEcon TODAY, you'll get everything above for...

ONLY $0.95

Then just $39.95/mo to maintain access.

All we ask is that you commit to implementing the information inside...

Take control of your credit score and secure your financial future.

Thanks For Visiting & We Look Forward To Helping You BOOST Your Credit!

P.S. In case you're one of those people (like me) who just skips to the end of the letter, here's the deal:

Once you purchase you'll get access to the trainings and tools inside the MyEcon System. 💪😎

Inside, we'll share with you how to get results and start enhancing your credit scores!

...using the same resources and strategies we've used to BOOST our own credit scores to get credit cards, loans, cars and so much more...

The amazing thing was that we did it all on our own thanks to everything you'll see inside MyEcon.

You're absolutely gonna love this system and the opportunities it will open up for your finances.

Congratulations in advance...

- Your Credit Partners,

Steven & Lanacia Rachel

How does the MyEcon System work?

This system will show you how to review your credit reports for errors and inaccuracies plus effectively demonstrate how to dispute them with the credit bureaus. The system also includes detailed guidance and training videos on how to improve your credit scores through proven strategies.

Can I really fix my credit on my own?

It is possible to repair your credit on your own, but you must have the right instructions and guidance.

How long does it take to see results from using the MyEcon System?

The length of time it takes to see results from a credit repair system can vary depending on the specific issues being addressed and the actions taken to improve your credit. In general, it may take several months to a year to see significant improvement in your credit score.

Will using the MyEcon System hurt my credit score?

Using MyEcon will not hurt your credit score as long as you follow the detailed steps inside the back office. The methods and proven strategies inside will put you on the right path to better credit scores.

Can this system help me get a mortgage or car loan?

Improving your credit score using MyEcon may increase your chances of getting approved for a mortgage or car loan. However, it is ultimately up to the lender to decide whether to approve your loan application, and other factors such as your income and debt-to-income ratio will also be considered.

Does this system have a referral program available?

Yes, once you get started with MyEcon you'll get a unique referral link to share with others. When you refer new members to MyEcon you will receive referral commissions plus residuals for each new member you generate.

What are the benefits of using MyEcon?

Some benefits of using this system include improving your credit score, qualifying for lower interest rates on loans, and potentially qualifying for credit or loans that may have previously been out of reach.

Get Access Now!

Take control of your credit score and secure your financial future.

© 2024 All Rights Reserved | Privacy Policy | Return Policy | Get A Website Like This

DISCLAIMER: The information provided on this website is for educational purposes only and is not intended as legal, financial, or professional advice. Since everyone's credit situation is different, results will vary depending on a variety of circumstances.

DISCLAIMER: The information provided on this website is for educational purposes only and is not intended as legal, financial, or professional advice. Since everyone's credit situation is different, results will vary depending on a variety of circumstances.